Historical tax haven opening its arms to the world

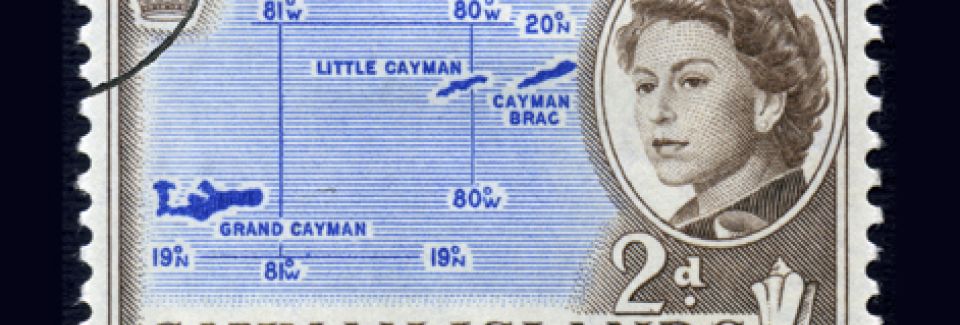

Cayman: the historical tax haven opening its arms to the world

The Cayman Islands of today has found fame as an international tax haven, while legend has it that this highly desirable tax-free status actually came to pass by decree of British royalty as far back as 1794. This historical tax haven is now opening its arms to the world, making it easier than ever before for non-native inhabitants to benefit from tax-free residency.

As legend has it, the Islands became a tax haven in November 1794, after a convoy of ten vessels of the HMS Convert were shipwrecked on the reef of Gun Bay at the East End of Grand Cayman and local settlers helped all those aboard to safety. It is believed that a member of British Royalty was involved in what is now locally referred to as The Wreck of the Ten Sail, and as a measure of gratitude to the brave local settlers, King George III issued a decree. This decree set out that Caymanians should never be conscripted to go to war, and that they should never be taxed, a decree which was then passed as legislation in Parliament. The Cayman Islands as a tax haven was born.

Now the Cayman government is opening its arms to the world, making it simple and straightforward for people from all over the world to obtain tax-free residency on the Islands. There are a number of ways to be granted tax-free residency depending on an individual’s particular circumstances.

There are two ways foreign nationals can apply for a 25 year, renewable residency and enjoy a tax-free status:

-

Those with independent means who want to live on the Islands and not work can apply to the Chief Immigration Officer for a Residency Certificate – this is valid for 25 years and is renewable, with original issue and renewal based on certain criteria which differs across the Islands. In Grand Cayman, the individual must give proof of annual income of at least CI$150,000 (the equivalent of under £113,000), not relying on any employment on the Islands, and an investment of CI$750,000 – CI$250,000 of which must be invested in Cayman real estate.

The income and investment levels for Little Cayman and Cayman Brac are even lower. The annual income level is just CI$75,000 and the local investment level is CI$250,000, CI$125,000 of which must be in real estate. A one-off fee of CI$20,000 is also payable on grant. Individuals must have a clean police record and provide satisfactory bank and personal references.

- Foreign nationals also have the option of investing a more substantial sum in a business (or multiple businesses) which generate employment on the Islands. This is essentially incentivised residency, intended to proactively attract investors and their families. If an individual can prove their personal net worth is in excess of CI$6,000,000 and invest a minimum of CI$2,400,00 in a Cayman business (or businesses), they may apply to the Chief Immigration Officer for a Certificate of Direct Investment. These certificates are also valid for 25 years and are renewable subject to approval from the Chief Immigration Officer once again. It costs CI$1,000 to apply for a certificate and CI$20,000 on issue. The holder of a Certificate of Direct Investment is entitled to reside in the Cayman Islands and work in the business/businesses in which they have invested, and the spouse and dependants of the holder can be granted a Direct Investment Holder’s (Dependant’s) Certificate, allowing them to reside there also.

The number of different options open to foreign nationals who wish to obtain tax-free residency, and the simplicity of the process, is clear evidence of a progressive Cayman government which is truly throwing open the doors of this tax haven to the modern world.